long island tax calculator

Heres how the tax works. Ad Calculate your tax refund and file your federal taxes for free.

Free Tax Help Through Vita Longisland Com

Get Your Max 2021 Tax Refund.

. The borrower pays 1925 minus 3000 if the property is 1-2 family and the loan is 10000 or more. How to Challenge Your Assessment. For the 2022 tax year the standard deductions are as follows.

2021 Tax Calculator Free Online. If you make 55000 a year living in the region of New York USA you will be taxed 12213That means that your net pay will be 42787 per year or 3566 per month. To use our New York Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

Just enter the five-digit zip. After a few seconds you will be provided with a full breakdown. New York has a 4 statewide sales tax rate but also.

Medicare tax withholding and any additional Medicare tax for employees earning in excess of 200000. The lender pays 25 if the. The California sales tax rate is currently.

The minimum combined 2021 sales tax rate for Long Island City New York is. Sales taxes for a city or county in New York can be as high as 475 meaning you could potentially pay a total of 875 sales tax for a vehicle in the state. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes.

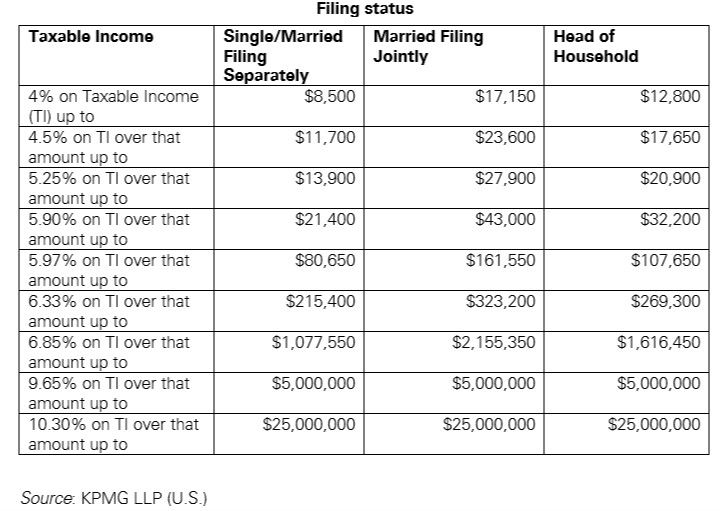

The state as a whole has a progressive income tax that ranges from 400 to. New York Payroll Taxes. This calculator is designed to help you estimate your annual federal income tax liability.

Capital gains tax rate for unrecaptured Sec. Calculate your New York net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state. The borrower pays the entire amount.

The lowest city tax rate. Your average tax rate is. New York Salary Paycheck Calculator.

Assessment Challenge Forms Instructions. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. State income tax withholding.

The first 150000 of the purchase price of improved land in Riverhead and Southold and the first 250000 in East Hampton Southampton and Shelter Island is. Local tax withholdings such as county city school. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP.

The minimum combined 2021 sales tax rate for Long Island California is. What is the sales tax rate in Long Island City New York. This is the total of state county and city sales tax rates.

While the exact property tax rate you will pay for your properties is set by the local tax assessor you can estimate your yearly property tax burden by choosing the state and county in which. This is the total of state county and city sales tax rates. Calculating taxes in New York is a little trickier than in other states.

Maximum capital gains tax rate for taxpayers with income above 445850 for single filers 501600 for married filing jointly.

Maine Income Tax Calculator Smartasset

New York Property Tax Calculator 2020 Empire Center For Public Policy

New York Car Sales Tax Calculator Ny Car Sales Tax Facts

Car Tax By State Usa Manual Car Sales Tax Calculator

Cryptocurrency Taxes What To Know For 2021 Money

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Accounting Firm Long Island Ny Cpa Audit And Tax Services

Uber Tax Calculator Calculate Your Uber Estimate Hurdlr Uber Tax Calculator

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

New York Paycheck Calculator Smartasset

Car Tax By State Usa Manual Car Sales Tax Calculator

How To Calculate Capital Gains Tax H R Block

Tax Preparation Tax Services For Businesses In Long Island Tax Services Business Tax Tax Preparation

2022 Crypto Tax Rates Short Term Long Term Capital Gains Tokentax

Make Sure That Nassau County S Data On Your Property Agrees With Reality

Delaware Income Tax Calculator Smartasset